Did you know that the global e-invoicing market is projected to reach $15.5 billion by 2026? This rapid growth highlights how businesses shift to e-invoicing and automation to eliminate manual delays and errors.

Now, imagine it’s a typical Monday morning. You’ve just completed a shipment and are ready to generate an invoice. You manually enter all the details, double-check for accuracy, and confidently send it out.

But a few days later, an error notification from the compliance portal pops up. A small mistake causes a compliance issue, delaying your payment and forcing you to redo the entire process.

Frustrating, right?

What if you use a system that generates invoices automatically and makes the entire process faster, easier, and more reliable?

That’s exactly what e-invoicing within SeaRates ERP offers.

In this guide, we’ll dive into how e-invoicing works, why it matters for your business, and how seamless ERP integration can eliminate invoicing challenges.

Understanding E-Invoicing

E-invoicing is a system that transforms how you manage invoices. Instead of manually creating invoices, e-invoicing allows you to generate them electronically.

Key Components of E-Invoicing

E-invoicing comes with several key components that simplify the invoicing process while ensuring compliance:

- Unique Invoice ID: This unique identifier ensures your invoice is valid and helps you track it easily.

- Verification Mechanism: Some systems include a digital signature or government-issued token to confirm authenticity.

- QR Code: Every e-invoice includes a scannable QR code. You can scan this code with your phone for instant verification.

- Built-in Compliance: Helps meet tax authority rules, apply correct rates, and avoid delays in reporting or tax claims.

Let’s take a closer look at the challenges freight forwarders face with traditional invoicing.

Challenges of Manual Invoicing for Freight Forwarders

Here are some of the key challenges of manual invoicing:

1. Time-Consuming Processes

Creating invoices manually takes a lot of time, especially when dealing with large shipments and multiple clients.

The constant back-and-forth between data entry, approvals, and corrections quickly adds up, affecting your team’s productivity.

2. High Risk of Errors and Penalties

Manual processes are prone to human error. Whether it’s a simple mistake in the invoice number, wrong shipment details, or an incorrect tax rate, such errors can lead to major compliance issues.

Even a small error can result in penalties from tax authorities or delayed payments, both of which directly impact your cash flow.

3. Difficulty in Tracking and Managing Invoices

Manual tracking makes it difficult to identify pending or incorrect invoices.

This lack of real-time tracking can cause delays in payments and create confusion for you and your clients.

4. Inconsistent Data Entry

If multiple people are involved in invoicing, inconsistencies in data entry are common.

Over time, these differences can lead to issues in adjusting accounts, especially during tax filing or audits.

5. Increased Risk of Fraud

Manual invoicing often involves physical documentation, which increases the risk of tampering or fraud.

This lack of digital security makes it difficult to maintain transparency and accountability.

How can you overcome these challenges?

Well, for that, let’s quickly compare manual vs. digital invoicing.

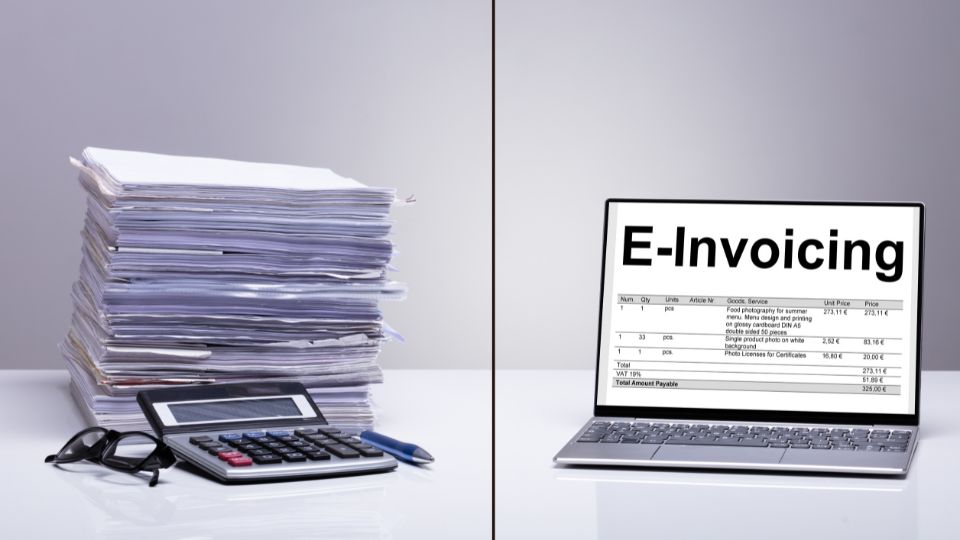

Manual vs. Digital E-Invoicing: A Quick Comparison

Switching to e-invoicing has clear benefits over the traditional manual process. Let’s take a closer look at how the two compare across different factors:

| Factors | Manual Invoicing | Digital E-Invoicing |

| Speed | Slow due to manual data entry and approvals. | Instant generation and submission to the e-invoicing platforms. |

| Error Rate | High risk of human error. | Low risk. Automation ensures accuracy. |

| Compliance | Requires manual updates to meet invoicing rules. | Automatic compliance with up-to-date e-invoicing rules. |

| Costs | Higher costs due to admin work and errors. | Lower costs reduce time and paperwork. |

| Fraud Risk | Higher risk due to manual processes. | Lower risk with secured digital records. |

| Tax Filing | Requires manual reconciliation of invoices. | Simplified tax filing as e-invoices are automatically linked. |

| Scalability | Difficult to scale with more invoices. | Easily scalable, as automation handles increased volume effortlessly. |

With digital invoicing, you get speed, accuracy, and peace of mind. It becomes seamless with automated invoice generation, submission, and compliance tracking.

While these challenges can be overwhelming, implementing the right strategies and tools can simplify the process. See how SeaRates integrates with your business.

ERP Integration: The Key to E-Invoicing and Automation

ERP integration is the backbone of effective e-invoicing. When your invoicing system connects directly with your ERP, it removes bottlenecks and automates the entire process.

Here’s how this integration transforms your operations:

1. Instant Invoice Generation

Your system generates invoices instantly using shipment details, order confirmations, or delivery milestones. This means no more waiting for manual input. The moment you enter the required data into the system, the invoice is ready. This speeds up transactions and cuts down on errors.

2. Automatic Tax and Compliance Checks

The ERP system automatically applies the correct tax codes and ensures compliance with local regulations. This minimizes the risk of invoice rejections, costly audit flags, and penalties, especially while working across different regions.

3. One Centralized Source of Truth

Your ERP stores all invoice data in one place. It keeps line items, tax details, payment status, and supporting documents organized. This eliminates confusion, making reconciliations, reporting, and audits faster and more accurate.

Integrating e-invoicing with your ERP system creates a unified, synchronized workflow that streamlines invoicing throughout your business.

| Are You Ready to Adopt E-invoicing? Learn how you can receive faster payments with fewer errors and seamless invoicing automation. Book a demo to learn more. |

Conclusion

Switching to e-invoicing is more than just a compliance requirement. It’s about transforming your invoicing process. With automated invoicing, you save time, reduce costly errors, and ensure accuracy.

Real-time tracking and seamless tax filing ensure your operations run smoothly with fewer compliance issues and faster payments.

SeaRates ERP automates invoice generation, ensures error-free compliance, and syncs directly with the e-invoicing platforms. It also handles multi-location compliance with ease.

Upgrade to e-invoicing today and simplify your invoicing process with accuracy, speed, and compliance.

Frequently Asked Questions

1. What is e-Invoicing?

E-invoicing is a way to create and share invoices electronically. It replaces manual and paper-based invoicing with a digital system.

2. Is e-invoicing only for tax compliance?

No. While compliance may be a driver in some regions, GST e-invoicing also improves speed, reduces errors, and enhances operational efficiency.

3. Do I need an ERP system to use e-invoicing and automation?

No, not necessarily. You can use e-Invoicing without an ERP.

But using it with an ERP saves more time and connects all your data in one place.

4. What are the main benefits of e-invoicing and automation?

E-invoicing helps you work faster and with fewer mistakes. It creates invoices automatically, so your team doesn’t have to enter details manually. This cuts down errors and speeds up the billing process.

Faster invoice processing leads to quicker payments, which improves your cash flow. Since the system stores all invoice data in one place, tax filing also becomes quicker and less stressful.