The Gulf Cooperation Council region processes over $45 billion in annual freight value, yet most operations still rely on fragmented systems that can’t talk to each other. GCC freight forwarding faces a critical inflection point, yesterday’s manual tracking and spreadsheet-driven logistics no longer cut it. Today’s winners deploy IoT logistics solutions paired with sophisticated data engineering in logistics to achieve what competitors can’t: real-time visibility, predictive intelligence, and operational agility that actually works across borders.

Why GCC Freight Forwarding Needs Smart Logistics Now

Traditional freight operations in the region operate through silos. A shipment crosses into Saudi Arabia, then the UAE, then Qatar, and at each crossing, tracking information fragments. Customs data doesn’t align with carrier data. Inventory systems don’t sync with delivery confirmations.

The result? Delays stretch from hours into days, costs spike unexpectedly, and customer frustration builds.

Here’s the uncomfortable truth: 63% of GCC logistics companies report their digital transformation initiatives are struggling with implementation costs and workforce capability gaps. They discovered that deploying sensors and GPS trackers without a coherent data architecture creates a different problem, millions of data points that nobody knows how to act on.

Yet this challenge presents an opportunity. Real-time tracking systems aren’t new technology. Smart logistics platforms have proven their value in other regions. What’s changed is that GCC governments are now actively funding modernization, e-commerce demand makes speed non-negotiable, and implementation costs are finally reaching levels where ROI becomes tangible.

How IoT Logistics Solutions Transform Freight Operations

When properly designed, IoT logistics solutions solve three specific operational problems that plague GCC freight forwarding today:

Visibility gaps cost money. A warehouse manager can’t tell if a shipment left the facility on time. A shipper doesn’t know if their pharmaceutical cargo maintained temperature. A carrier can’t confirm a delivery actually occurred. IoT sensors, GPS trackers, temperature monitors, vibration detectors, humidity sensors, provide continuous data streams that eliminate these blind spots.

Reactive operations become proactive. Without sensor data, logistics managers respond to problems after they occur, a vehicle breaks down, a package gets damaged, a route backs up. With real-time tracking powered by IoT, problems trigger automated responses. A temperature deviation alerts cold-chain managers before spoilage happens. A traffic jam triggers automatic rerouting before delays cascade. A predictive maintenance sensor flags equipment degradation before a breakdown occurs. This shift from reactive to proactive saves approximately 20% of vehicle downtime and 15% of maintenance costs according to implementations across the region.

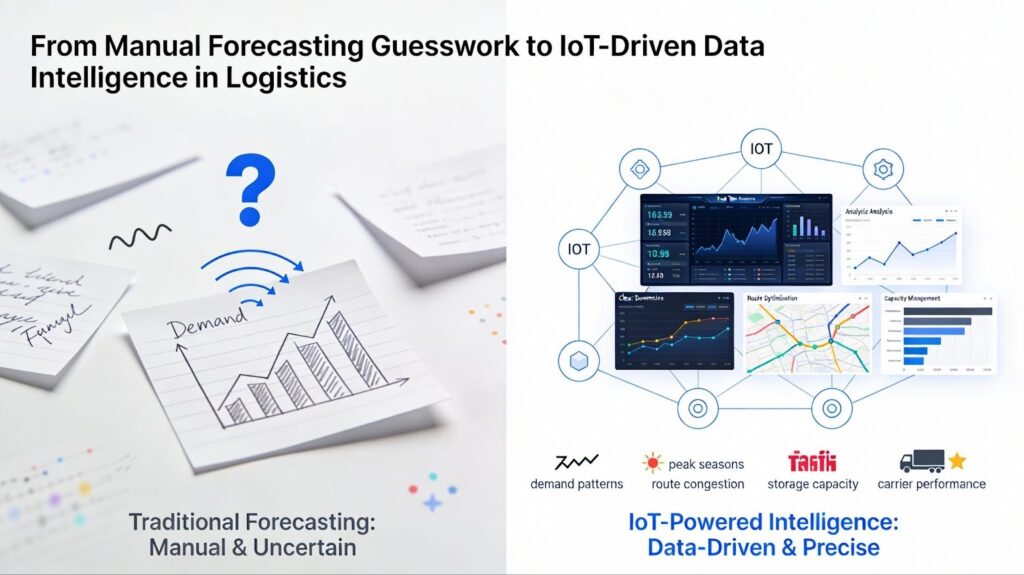

Decision-making moves from guesswork to data. Manual forecasting often misses demand patterns hidden in shipment volumes, peak seasons, and route congestion. Connected systems generate actionable intelligence, which routes typically back up, which storage areas reach capacity, which carriers consistently outperform targets.

Data Engineering: Converting Sensor Noise into Intelligence

Here’s where most IoT deployments fail: they generate mountains of data nobody can interpret. Sensors emit readings constantly, speed, location, temperature, humidity, vibration, creating overwhelming information streams. Without proper data engineering in logistics, this data becomes a liability rather than an asset.

Effective data engineering for GCC freight operations requires three critical elements:

Data infrastructure that scales. Warehouse management systems, transportation systems, customer databases, and IoT sensors each generate different data formats, frequencies, and quality levels. Building pipelines that ingest this chaos requires robust architecture. Modern implementations use cloud-based data platforms (Snowflake, Amazon Redshift) as central repositories, Apache Spark for processing massive datasets, and automated orchestration tools (Apache Airflow) that continuously pull and transform data without manual intervention. This isn’t optional, it’s fundamental to converting sensor streams into usable intelligence.

Quality assurance embedded from collection forward. Garbage data creates garbage insights. Real implementations enforce data validation rules at the source, check sensor accuracy continuously, and flag anomalies immediately. A major carrier attempted to skip this step, only to discover their GPS trackers were reporting impossible speeds that corrupted their entire route-optimization model. They lost three months rebuilding data pipelines with proper validation.

Real-time decision engines feeding back to operations. Data engineering enables machine learning models that optimize routing in real time. These models analyze historical patterns, which routes typically face delays, how the weather impacts delivery times, which carriers perform best under the specific conditions, and feed recommendations to dispatchers and planners. Organizations implementing this properly report 25-30% improvements in delivery predictability and roughly 50% improvement in forecast accuracy.

Real-Time Tracking That Actually Works for GCC Border Crossings

The GCC presents unique tracking challenges that generic solutions miss. Cross-border shipments encounter fragmented customs regulations, varying documentation requirements, and inconsistent processing speeds at each border. Real-time tracking must bridge these gaps.

Advanced systems combine multiple data layers:

Physical tracking via IoT. GPS devices and RFID tags monitor shipment location continuously. But GPS alone misses crucial context, is the vehicle stopped at a border crossing waiting for clearance, or has it broken down? Temperature variance, is the cold chain failing, or is the refrigerator simply cycling normally?

Administrative tracking via digital customs integration. Saudi Arabia’s Fasah single-window platform cuts import clearance times from a week to mere hours by digitizing customs documentation. When real-time tracking systems integrate with these platforms, they provide end-to-end visibility, not just “the shipment moved from Point A to Point B,” but “the shipment exited Riyadh at 14:00, arrived at Al-Batha customs at 16:30, completed documentation review by 17:15, and crossed into UAE at 18:45.”

Predictive alerting based on pattern analysis. Machine learning models trained on historical data flags when shipments deviate from expected patterns. A truck that typically crosses the Riyadh-Dammam corridor in 8 hours but shows 12 hours this time triggers investigation, not because the tracking system failed, but because the data shows something unexpected occurred.

The practical impact: forwarding companies deploying integrated real-time tracking across GCC freight forwarding corridors report 20-30% reduction in delivery delays and 15% decrease in inventory carrying costs.

The Specific Challenges Nobody Talks About

Implementation experience reveals obstacles that technology marketing ignores:

Legacy systems resist integration. Most established GCC logistics companies run warehouse management software that’s 15+ years old. Connecting modern IoT platforms to ancient systems causes data syncing failures, duplicate records, and operational confusion. One carrier attempted connecting their 2008-vintage freight management system to contemporary IoT platforms; they created more problems than they solved. The solution required complete system replacement rather than integration, extending their project timeline by 18 months.

Workforce capabilities lag technology expectations. Deploying smart logistics platforms requires professionals who understand both logistics operations and data engineering. GCC logistics companies report significant skill shortages, few team members truly understand machine learning model interpretation or data pipeline architecture. Training existing staff helps, but it takes time, and high-turnover roles create continuous capability gaps.

Connectivity remains fragmented. While UAE and Saudi Arabia maintain robust urban infrastructure, cross-border routes still encounter connectivity gaps. 5G deployments are improving this, but many inland routes rely on older cellular networks with bandwidth limitations. IoT systems operating across these gaps experience latency and dropped connections, compromising real-time capabilities.

Security grows more complex. Connected systems expose sensitive freight data, shipment contents, customer locations, pricing information, to cyberattacks. Proper security frameworks add cost, complexity, and operational friction. Companies implementing half-measures (deploying IoT without proper encryption or access controls) later discovered they’d created vulnerability rather than visibility.

What Actually Works: Practical Implementation Patterns

Organizations achieving measurable success with IoT logistics solutions and data engineering follow consistent patterns:

Begin with specific use cases rather than enterprise-wide rollouts. DB Schenker started with temperature-sensitive biopharmaceuticals, their highest-risk, highest-value segment. They initiated a project with Envirotainer to deploy real-time container data visibility using RelEye live monitoring specifically for pharma shipments. The key result: they reduced manual work while maintaining high-quality oversight, justifying expansion to other cargo types.

Partner with established technology providers rather than building from scratch. Integrating IoT, cloud platforms, and machine learning requires specialized expertise. Companies attempting in-house development often underestimate complexity. Strategic partnerships with vendors offering integrated platforms accelerate deployment and reduce risk.

Invest in data engineering before deploying sensors. The most common mistake: installing thousands of IoT devices, then discovering the organization lacks infrastructure to process the data. Reversing this, building data platforms first, then adding IoT devices, creates proper foundations for scaling.

Market Tailwinds Supporting Transformation

GCC governments have committed substantial resources to logistics modernization. Saudi Arabia’s National Transport and Logistics Strategy targets top-10 global positioning by 2030, with investments in 59+ logistics zones and customs digitization already showing results. The UAE’s logistics infrastructure expansions and Dubai’s comprehensive modernization initiatives create momentum. These aren’t peripheral projects, they’re central to national economic diversification strategies.

E-commerce growth accelerates the need for smart logistics capabilities. The region’s e-commerce market is projected to surpass USD 708.7 billion by 2033, and this growth demands dense fulfillment networks with optimized operations, precisely what smart logistics platforms enable. Last-mile delivery challenges, 42% of Middle East e-commerce companies cite inefficient last-mile as their primary growth constraint, create urgent demand for the optimization that data engineering in logistics delivers.

Regional warehouse automation is expanding rapidly. The Middle East warehouse robotics market, valued at USD 340 million in 2024, is expected to surpass USD 714 million by 2030, growing at approximately 12.2% annually. This infrastructure modernization creates natural integration points for IoT and data engineering systems.

Moving Forward

The convergence of government modernization initiatives, e-commerce acceleration, and proven technology solutions creates a window where GCC freight forwarding leaders can establish lasting competitive advantages. Organizations that invest in integrated IoT logistics solutions and supporting data engineering in logistics infrastructure today will operate dramatically more efficiently than competitors who delay.

The path forward isn’t complicated: select specific operational challenges, partner with capable technology providers, build data foundations before deploying sensors, and invest in team development. The organizations succeeding with this approach report 20-30% efficiency gains, significantly improved customer satisfaction through real-time tracking capabilities, and operational resilience that older competitors simply cannot match.

The question for GCC logistics leaders isn’t whether to transform, it’s how quickly they can build the capabilities that will define the next decade of competitive positioning.